Associate Professor of Finance at CUNEF Universidad

I'm also the Director of the Master in Finance at CUNEF Universidad.

My main research line focuses on empirical asset pricing and its intersection with machine learning. I am also interested in the study of financial markets feedback effects on the real economy and the market impact of disclosure. Finally, as a former quant, I still enjoy researching more quantitative and mathematical finance topics. My work has been published in leading finance journals including the Journal of Financial Economics, The Accounting Review, Journal of Corporate Finance and the Journal of Empirical Finance.

On the practitioner side, I'm a systematic investor at Noax Capital, occasionally advising institutional investors and family offices.

Research

Selected Papers

R&D Disclosure and Short-term Investors: Evidence from Mandated Patent Disclosure

Iván Blanco, Sergio García, David Wehrheim

The Accounting Review (2026)

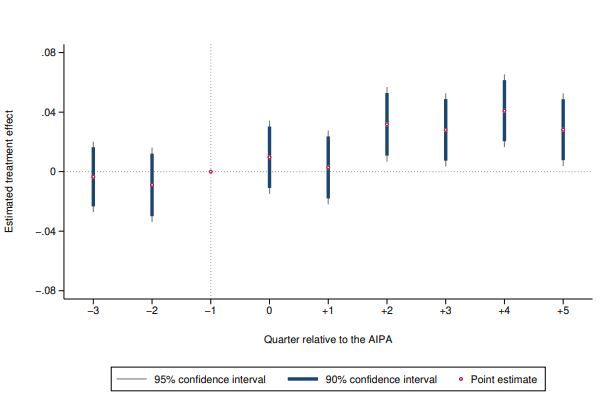

We examine how the prospect of research and development (R&D) disclosure affects a firm's institutional investor base. Difference-in-differences (DiD) regressions around the enactment of the American Inventors Protection Act (AIPA), which mandated the public disclosure of patent applications within 18 months of filing, show that short-term institutional investors increase their holdings before any public information is released, whereas long-term investors do not adjust their positions. This anticipatory shift is consistent with theoretical predictions that expected disclosure strengthens short-horizon investors' incentives to acquire and trade on private information. We further document that stock prices reflect more firm-specific information leading up to disclosure and that improved liquidity at disclosure enables short-term investors to partially unwind their positions. Our paper offers novel evidence on how increases in the expected likelihood of disclosure shape investor behavior and the composition of firms' investor bases.

Read Paper →

The Bright Side of Financial Derivatives: Options Trading and Firm Innovation

Iván Blanco, David Wehrheim

Journal of Financial Economics (2017)

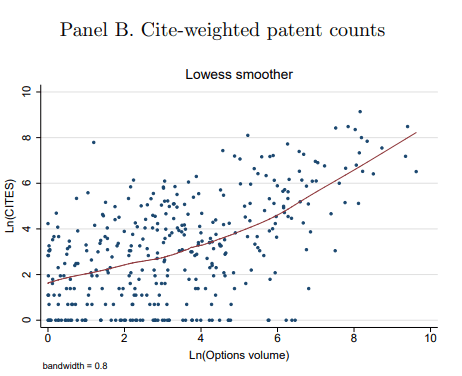

Do financial derivatives enhance or impede innovation? We aim to answer this question by examining the relationship between equity options markets and standard measures of firm innovation. Our baseline results show that firms with more options trading activity generate more patents and patent citations per dollar of R&D invested. We then investigate how more active options markets affect firms' innovation strategy. Our results suggest that firms with greater trading activity pursue a more creative, diverse and risky innovation strategy. We discuss potential underlying mechanisms and show that options appear to mitigate managerial career concerns that would induce managers to take actions that boost short-term performance measures. Finally, using several econometric specifications that try to account for the potential endogeneity of options trading, we argue that the positive effect of options trading on firm innovation is causal.

Read Paper →All Publications

Published Papers

Iván Blanco, Sergio García, David Wehrheim

The Accounting Review (2026)

Iván Blanco, Jose M. Martín-Flores, Alvaro Remesal

Journal of Corporate Finance (2024)

Iván Blanco, Miguel De Jesús, Alvaro Remesal

Journal of Empirical Finance (2023)

Alejandro Baldominos, Iván Blanco, Antonio José Moreno, Rubén Iturrarte, Óscar Bernárdez, Carlos Afonso

Applied Sciences (2018)

Iván Blanco, David Wehrheim

Journal of Financial Economics (2017)

Iván Blanco, Alejandro Balbás, José Garrido

Risks (2014)

Working Papers

Iván Blanco, Fabrizio Ferraro, Giovanni Valentini, David Wehrheim

Working Paper

Work in Progress

Iván Blanco, Alvaro Remesal

Work in Progress

Iván Blanco, Sergio García, Alvaro Remesal

Work in Progress

Media & Commentary

Articles & Commentary

Inteligencia artificial en los mercados financieros: evidencia empírica en el S&P 500

¿Cómo afectan los desastres naturales a las decisiones de los inversores institucionales?

Aprendizaje profundo para series temporales en finanzas:aplicación al factor momentum

Research Coverage

Should you invest in overlapping momentum investing strategies?

Overlapping momentum strategies - Gains from diversification of timeframe models

Teaching

Courses

Asset Pricing

Advanced course covering modern asset pricing theory, factor models, and empirical applications in portfolio management.

Machine Learning & Investments

Application of machine learning techniques to investment strategies, including deep learning for momentum and systematic trading.

Financial Derivatives

Comprehensive study of derivative instruments, pricing models, and risk management applications in modern finance.

Executive Training

Quantitative Investments

Systematic approaches to portfolio construction and quantitative trading strategies.

Factor Investing

Deep dive into factor-based investing, from theory to practical implementation.

Machine Learning in Asset Pricing

Advanced techniques in applying ML to asset pricing and return forecasting.

Systematic & Algorithmic Trading

Design and implementation of systematic trading strategies and execution algorithms.

Contact

Address

CUNEF Universidad

C. de Almansa, 101

28040 Madrid, Spain